Sell-Side Advisory

Focused on maximizing value, maintaining confidentiality, and certainty of close.

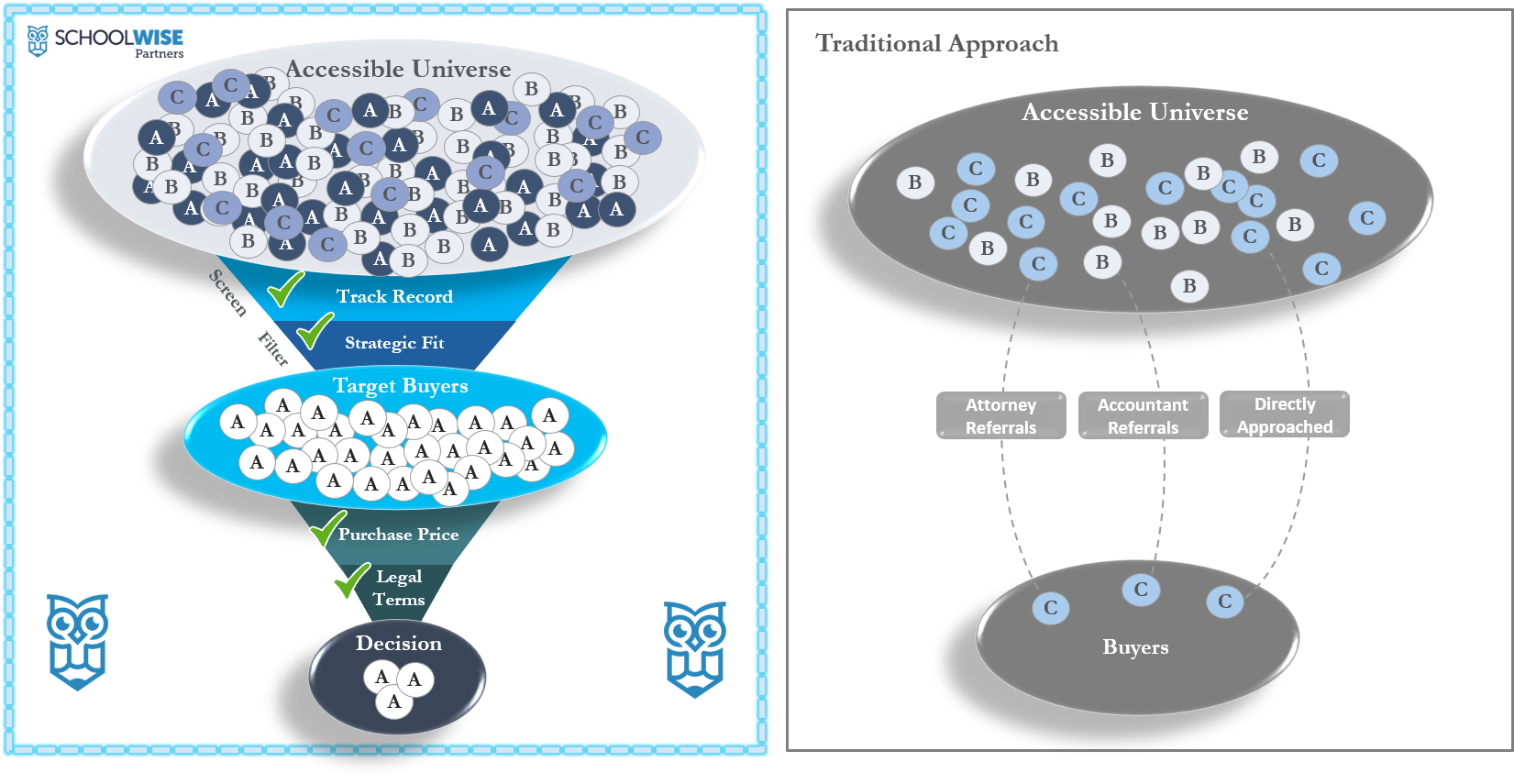

Proven Approach to Maximizing Value

When it comes to selling your school business, achieving the best possible results can be challenging without the guidance of a specialized advisor. The journey is filled with risks, pitfalls, and obstacles, and navigating it alone or with the wrong advisor often leads to less favorable outcomes. However, by partnering with SchoolWise, a team of experts specializing in the child care industry, you can leverage our extensive knowledge, valuable connections, and exceptional transaction leadership skills to chart the optimal path for maximizing the value of your sale and accomplishing your transaction goals.

Our dedicated team begins by thoroughly understanding and prioritizing your objectives, aiming not only to maximize sale proceeds but also to ensure the best cultural and strategic fit for your business. Armed with sector expertise, a comprehensive understanding of the buyer landscape, and a commitment to meticulous process execution, we strive to generate the most favorable outcome for you. Our deep understanding and focus on the early education industry provide us with a unique advantage—we know how to position school owners for optimal valuation, identify the most active strategic and financial investors in the space, and ensure they are properly capitalized.

As your trusted advisor and guide, we will lead you through a seamless and thorough process that has been honed through countless transactions. Our approach is designed not only to achieve maximum value but also to do so efficiently, with utmost confidentiality and professionalism. If you are considering selling your school, SchoolWise Partners is here to support you every step of the way, providing the expertise and guidance you need to succeed.

75+

Sell-Side

Engagements

$850+ Million

Transaction Value

from Sell-Side Clients

95%

Success

Rate

Maximizing Transaction Value & Ensuring a Smooth Transition

Deep Sector Expertise

Our firm stands apart because of our undivided focus on education and our demonstrated ability to work with organizations of all sizes, from small multi-unit operators to large corporate education companies. As the leading advisor, we have gained tremendous market intelligence, allowing us to customize approaches for potential buyers.

Thought Leadership

Our ability to create opportunity and deliver successful outcomes is driven by the depth and breadth of our industry knowledge and expertise. We bring together unparalleled transaction and operational experience along with a background in investment banking and entrepreneurship, providing unique expertise that adds value.

Sophisticated Preparation

Buyer enthusiasm is partially driven by sophisticated informational materials that provide a compelling narrative and positioning thesis. As seasoned bankers, we know how to position your family of schools in the best light possible with our industry-leading marketing materials which can significantly impact the perceived value of your schools.

Transaction Management

The process of selling your company is incredibly time consuming and disruptive. Our team manages every aspect of the transaction process so you can stay focused on your day to day operations. We also address all things that may come up during due diligence to avoid surprises and potential issues that may impact the transaction.

Proprietary Buyer Network

Our team is deeply connected with key industry players including strategic operators, strategic and financial buyers, private equity backed portfolio companies, sector-focused real estate funds, etc. Our buyer relationships and connections in the industry are unmatched and critical to our clients’ transaction success.

Trust & Confidentiality

As a trusted advisor with experience in this sector, we understand the sensitivities and importance of maintaining confidentiality throughout our engagement. We have developed proven strategies to ensure confidentiality throughout so that your families and staff only learn about your transaction when you are ready to share it with them.

What to Expect: Chronology of the Transaction

A successful outcome begins with a proven process. Our focus is always on how decisions along the way impact the outcome. Below is a top-level overview of the transaction process, giving you a glimpse of what to expect when you decide to sell your school business.

Phase I: Preparation & Positioning

During the Preparation Phase, we undertake a series of essential steps to ensure a successful transaction. This phase encompasses several key components, including identifying seller objectives, generating due diligence materials, developing market positioning strategies, preparing comprehensive offering materials, and organizing an effective go-to-market plan.

Strategic Planning: We begin by delving into a deep understanding of your business, seeking to learn more about its unique qualities and assessing its suitability for entering the market. In detailed discussions, we explore your objectives, including pricing expectations and post-sale goals.

Information Gathering: Upon the signing of a confidentiality agreement, we request a targeted list of informational materials. This enables us to gain a comprehensive understanding of your school's operational and performance history, as well as its competitive position within the market.

Evaluation & Valuation: We conduct an in-depth evaluation to determine the value of your business and its associated real estate. This involves a thorough review of your school's financial performance, including the process of "normalizing" your income statement. Additionally, we conduct comprehensive market research and evaluate the dynamics of the real estate landscape.

Value Enhancement: Our team identifies potential weaknesses, risks, and areas for improvement within your business. By addressing these areas before going to market, we aim to enhance the overall value of your school and maximize its appeal to potential buyers.

Engagement: Once we have mutually agreed upon the terms, we solidify our partnership through the execution of an engagement agreement. This establishes SchoolWise Partners as your exclusive sell-side advisor, ensuring dedicated support throughout the entire process.

By diligently undertaking these crucial tasks in Phase I, we lay the foundation for a successful transaction, positioning your school optimally in the market and setting the stage for future phases of the process.

Phase II: Marketing & Negotiations

During the Marketing Phase, we undertake a series of targeted activities to confidentially identify and engage potential buyers, conduct a competitive limited auction process, solicit initial offers, and ultimately select the most suitable buyer through strategic negotiations.

Offering Materials: We meticulously finalize the confidential information memorandum and supplemental financial model, creating comprehensive documents that effectively showcase the strengths and potential of your school. These materials are then distributed exclusively to approved target buyers, ensuring the highest level of confidentiality.

Target Buyers: Our experienced team identifies and approaches buyers who align with your objectives, including pricing expectations and strategic fit. We carefully manage the flow of information through a secure data room, facilitating strategic discussions exclusively with interested parties who meet our stringent criteria.

Confidentiality: Before providing access to the online data room and distributing additional information, we ensure that potential buyers execute confidentiality agreements. This step safeguards your sensitive information and ensures that only qualified buyers gain access to the detailed offering materials.

Meetings & Tours: We expertly manage buyer inquiries and calls, minimizing disruption to your day-to-day operations. For select buyers, who express a genuine interest, we coordinate confidential tours of your school outside of regular hours. Every meeting and tour is meticulously organized to maintain the utmost confidentiality.

Offer Evaluation: In the offering materials, we establish a due date for all written offers. During this critical phase, we carefully review each submission, pushing all parties to submit a final round of bids. Our goal is to facilitate a competitive environment, maximizing your options and enabling you to choose the most compelling offer.

By executing these key strategies during Phase II, we ensure a robust marketing process that attracts qualified buyers, maintains confidentiality, and provides you with a range of attractive offers to consider. Our expertise in negotiations allows us to guide you towards selecting the most suitable buyer, setting the stage for a successful transaction.

Phase III: Due Diligence & Legal

The Diligence & Legal Phase involves managing the buyer's confirmatory "due diligence" process, equivalent to a thorough inspection, and engaging in negotiations while drafting legal documents to finalize the sale.

Quality of Earnings: The buyer will engage a reputable third-party CPA to meticulously review and validate the company's financials and operational position as presented in the offering materials. This step ensures transparency and builds trust between all parties involved.

Real Estate Inspections: We facilitate a comprehensive series of inspections on the property, including a thorough survey, conditions report, Phase I environmental assessment, and assessments for mold and asbestos. By addressing these aspects, we ensure that all parties have a complete understanding of the property's condition.

Purchase Agreement: This crucial stage entails the drafting and negotiation of a robust and mutually binding contract. The purchase agreement lays down the specific terms and conditions that govern the sale of the business and associated real estate, providing clarity and legal certainty for all parties involved.

Licensing & Transition: Our team guides both the buyer and the seller through the necessary processes involved in transitioning ownership, particularly with the state's licensing officials. We provide support in facilitating a smooth announcement to teachers, staff, and parents, ensuring a seamless transition for all stakeholders.

Pre-Closing Processes: We diligently oversee the fulfillment of all seller obligations, including obtaining third-party consents and approvals as required. Additionally, we ensure the resolution of any post-closing obligations, promoting a smooth and efficient closing process.

By effectively managing the Diligence & Closing Phase, we mitigate potential hurdles, address key legal and regulatory aspects, and facilitate a seamless transition of ownership. Our goal is to ensure a successful and satisfactory conclusion to the transaction while safeguarding the interests of all parties involved.

Phase IV: Closing & Transition

The Closing & Transition Phase marks the final phase of the transaction, where we guide you through the necessary steps to ensure a smooth transition and address any remaining obligations following the sale.

Transfer of Ownership: We facilitate the formal transfer of ownership from the seller to the buyer, ensuring that all necessary legal and administrative requirements are met. This includes updating ownership records with relevant government agencies and notifying regulatory bodies of the change in ownership.

Employee Transition: As part of the post-closing process, we assist in managing the transition for employees, ensuring a seamless transfer of employment contracts and benefits to the new owner. We work closely with both parties to address any employee concerns and facilitate a smooth integration process.

Vendor Transfers: We help manage the communication with vendors and suppliers, notifying them of the change in ownership and updating necessary account information. This ensures a smooth transition of business relationships and continuity of services.

Staff & Parent Communication: We assist in developing a comprehensive communication plan to inform the staff and parents about the change in ownership and address any concerns or questions they may have. Our goal is to maintain positive relationships and ensure a seamless experience for all parties involved.

Post-Closing Obligations: We assist in fulfilling any remaining post-closing obligations, such as resolving outstanding contingencies, completing any necessary filings or registrations, and ensuring the settlement of any remaining financial or contractual obligations.

Throughout the Post-Closing Processes, our dedicated team is committed to providing ongoing support and guidance, leveraging our expertise and experience to ensure a successful transition and integration for all stakeholders involved.

Maximizing Value: The SchoolWise Difference

Our time-tested transaction process is proven to generate more value in terms of price, closing expectations, strategic fit, and transition. The SchoolWise Partners team has helped many school owners realize the sale of their school in a way that provided a more rewarding financial outcome than was ever imagined. We do this by putting our years of experience to work on your behalf.

Interested in the Confidential Sale Process?

We invite you to reach out and schedule a consultation with a member of our team. We are happy to provide a complimentary valuation on your business and real estate!